Introduction to Transfer of Property: Key Concepts and Principles

Introduction

Transfer generally refers to the movement of ownership or rights from one entity to another or passing of ownership or rights in property from one person or entity to another.

Property generally refers to anything that is owned by a person or entity and has value, which can include physical items (like land, buildings, or personal possessions) as well as intangible items (like intellectual property or financial assets. It is a legally recognized right or interest that a person or entity has in something.

An introductory overview of property transfer typically encompasses several core principles:

1. Ownership: Determining the legal holder of property title and associated ownership rights.

2. Methods of Transfer: It includes transferring through sale, gift, inheritance, exchange, or lease.

3. Legal Requirements: Outlining the essential conditions and procedures necessary to execute a valid property transfer, which may involve contracts, deeds, registrations, or other legal instrument.

4. Entitlements and Obligations: Determining the rights and responsibilities of all parties engaged in the transfer, including any associated liabilities.

5. Legal Framework: Examining the statutes, regulations, and legal principles that govern property transfers, which can differ significantly across jurisdictions.

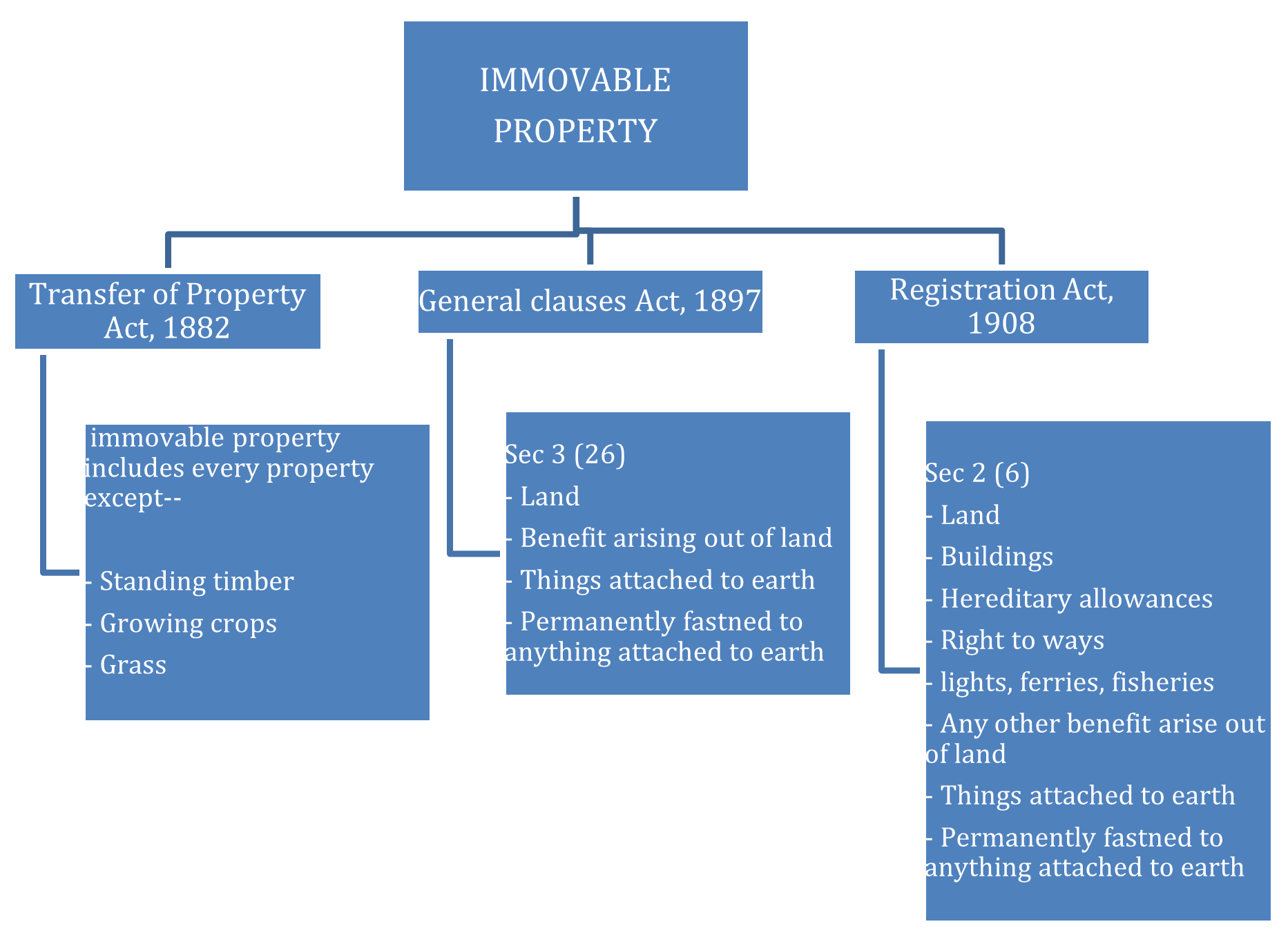

6. Types of Property: Addressing specific regulations and considerations related to distinct categories of property, such as real estate (land and buildings), personal possessions (movable assets), and intellectual property (intangible creations).

General Provisions of the Transfer of property Act 1882-

Section 2 of the Transfer of Property Act, 1882 delineates the ambit of applicability of the Act, specifying its governance over transfers of property effected by living persons (inter vivos).

● It expressly excludes transfers by operation of law or testamentary dispositions.

● The Act extends throughout India

● It does not apply to Jammu & Kashmir and Punjab

It is a secular law and applies to everyone within its domain. Although the provisions of Gift are not to be applied on Muslims

-Instrument:

● It means a non-testamentary document.

● It does not include will.

-Registered:

● It means the property can be registered in any part of the territory to which this act extends.

● Registration Act 1908 is applied here.

-Actionable Claim:

It refers to a claim or right to recover a debt, money, or other movable property by way of a legal action, whether existing, future, conditional, or contingent, and including any claim for damages or compensation or for the enforcement of any remedy to which a person is entitled under any law.

They can be transferred or assigned by their owners to another person, subject to certain conditions and limitations.

It can be transferred or assigned under Section 130 of the TPA. However, the transfer must be in writing, signed by the transferor, and should clearly identify the debt, claim, or right being transferred.

Certain actionable claims, such as claims for unliquidated damages in tort, cannot be transferred. Also, claims against the government cannot be transferred unless permitted by law.

The transferee of an actionable claim can enforce it against the debtor or person liable for the claim, subject to the terms of the transfer and any defences that may exist.

What is Transfer of Property?

Section 5 of the acts provides the definition of Transfer of Property. It states the transfer of property is an act by which a living person conveys property, in present or future, to one or more other living persons, or to himself, or to himself and one or more other living persons.

Section 5 of the Transfer of Property Act (TPA) delineates the fundamental prerequisites that must be satisfied for a transfer of property to be valid under the law. These prerequisites encompass the following:

1. The transferor must possess the intention to transfer the property.

2. The transfer must be executed by a person who holds legal ownership or authorization to transfer the property.

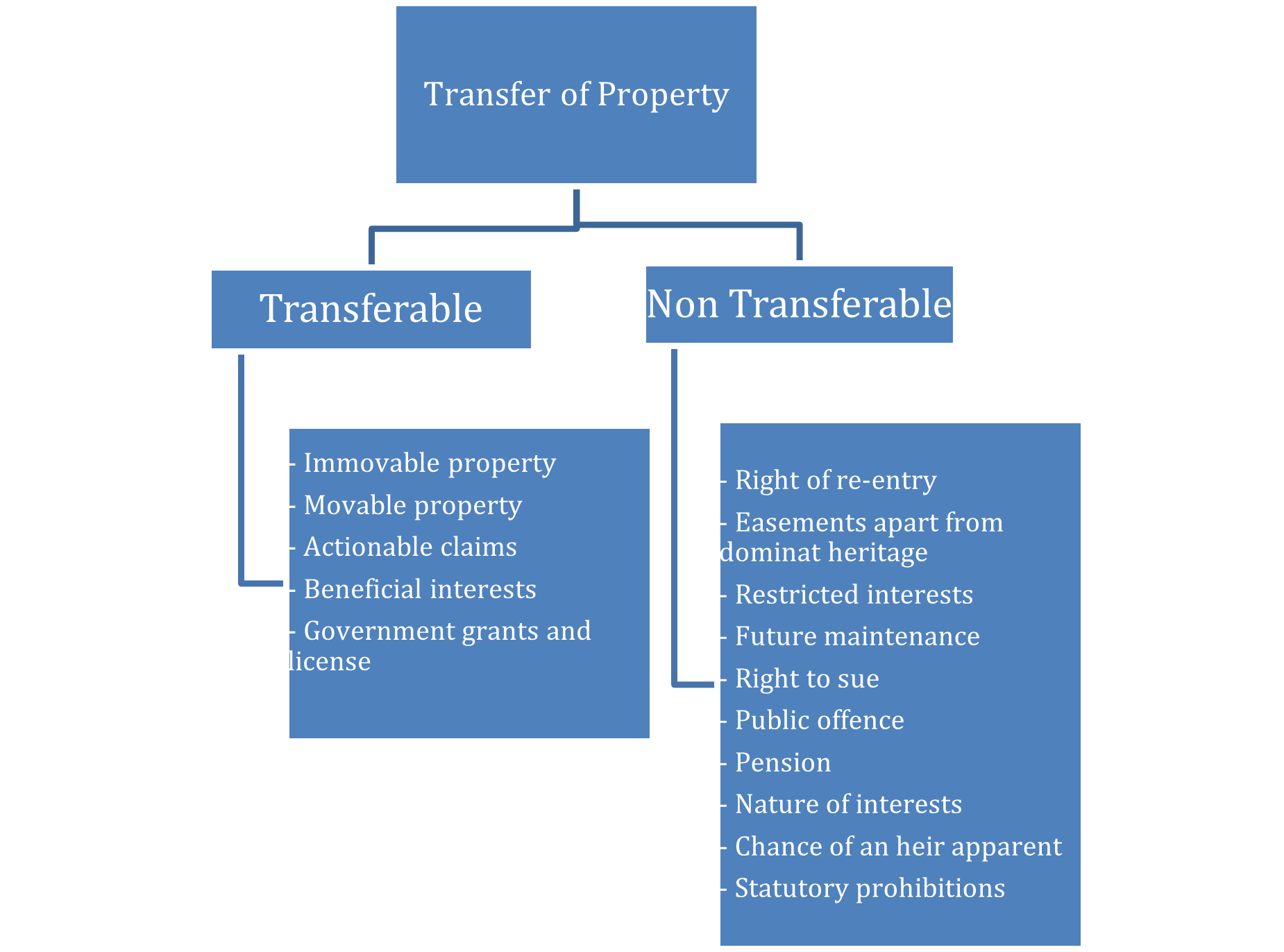

3. There must exist a transferee who is competent to receive and hold the property.

4. The subject matter of the transfer must constitute property that is transferable according to legal provisions, encompassing both movable and immovable assets.

5. Except in instances falling within specified exceptions (such as gifts under Section 122 of the TPA), the transfer must be accompanied by consideration. Consideration may take various forms, including monetary payments, goods, services, or other valuable considerations.

6. In cases where the value of the property being transferred exceeds a prescribed threshold as stipulated by law, the transfer generally necessitates a written document that must be registered.

Case:

Jugalkishore v. Raw Cotton Co. Ltd, AIR 1955

Supreme Court held that the words 'in present or in future in Section 5 of the Transfer of Property Act qualify the word 'conveys' and not the word 'property'.

Transfer of any non-existent or future property operates only as a contract which may be performed in future and can be enforced as soon as the property comes into existence.

Requirements for a Valid Transfer

- Writing, attestation and Registration: The transfer of property must be in writing. It must be attested and registered.

- Legal Competency: The parties involved must have legal capacity to enter into the agreement. This means that the transferor and transferee must be of sound mind and above the age of majority.

- Proper Description: The property being transferred must be described precisely to avoid ambiguity and disputes.

- Clear Intent: The parties must explicitly express their intent to transfer the property rights from the seller to the buyer

Competency to Transfer

Section 7 of the act states regarding the competency to transfer. It states the transferor must be a living person at the time of transfer and competent to contract. This includes human beings or juristic persons like companies or associations.

The transferor must have the right to transfer the property being transferred. This includes being entitled to transfer the property or authorized to dispose of the property if it is not his own. A minor being incompetent to contract cannot transfer a property.

The Transferor can transfer the property either wholly or in part and either absolutely or conditionally as prescribed by law.

Operation of Transfer

Section 8 of the Transfer of Property Act specifies the general principles governing the operation of property transfers:

Unless expressly or implicitly stated otherwise, a transfer of property conveys all the rights and interests that the transferor is capable of passing to the transferee. The transfer encompasses not only the property itself but also all its legal incidents.

- For land: Easements, rents, profits, and things attached to the earth.

- For machinery: Movable parts attached to the earth.

- For a house: Easements, rent, locks, keys, doors, windows, etc.

- For debts/claims: The securities for the debt, unless they secure other debts.

- For money/income-yielding property: The interest or income accruing after the transfer.

There is a legal presumption that the transfer includes all legal incidents associated with the property. This presumption can be rebutted only if a different intention is explicitly expressed or necessarily implied.

The presumption does not apply in certain cases, such as transfers from the transferee back to the transferor. Additionally, arrears of interest accrued before the transfer are not included in the transfer of a debt or actionable claim.

It safeguards the interests of both the transferor and transferee by providing a clear framework for determining the scope of transferred property rights.

How transfer made?

The transfer can be made either orally or in writing. As per Section 9 of the Transfer of Property Act, A transfer of property can be made without writing in cases where a writing is not explicitly required by law. It is known as Oral Transfer. This section does not apply in cases where a writing is required by law, such as in cases of immovable property.

Conditions and Restrictions

Section 10 of the Transfer of Property Act (TPA) renders void any condition that completely restrains alienation in a property transfer. However, partial restraints on alienation are permissible under this section.

Essentials:

- A condition that completely restrains alienation in a property transfer is void.

- Partial restraints on alienation are legally valid.

- If the condition is void still the transfer will be valid.

Exception:

- Lease agreements are exception to this general rule as it is for the benefit of the Lessor.

- Property may be transferred to or for the benefit of a women, not being a

- Hindu, Muhammadan or Buddhist. So, she shall not have power during her marriage to transfer or change for her benefit/ beneficial interest.

Case Rosher v. Rosher

In this case, the court held that these conditions amounted to an "absolute restraint" on the son's ability to alienate the property, and were therefore void under Section 10 of the Transfer of Property Act.

As per Section 11 of TPA conditions that are inconsistent with the nature of the interest transferred prohibits the imposition of any condition that restricts the lawful enjoyment of property transferred absolutely. Such conditions are deemed void, and the transferee retains the right to possess and dispose of the property without regard to the nullified condition.

It applies when the transfer creates an absolute interest in favour of the transferee. The terms of the transfer must specify that the transferee's interest in the property must be enjoyed or applied in a particular manner.

It provides an exception whereby the general rule does not apply if the transferor owns another piece of immovable property. In such cases, conditions or restrictions on the transferee's right of enjoyment can be imposed for the benefit of that other property.

As per Section 12 TPA it addresses conditions that render an interest in property determinable based on insolvency or attempted alienation. It declares certain conditions void in property transfers that terminate the interest upon the occurrence of uncertain events, such as the transferor's insolvency or attempted alienation.

Essentials:

- It applies when there is a transfer of property.

- The transfer must include a condition or limitation that makes the interest in the property determinable based on insolvency or attempted alienation.

- -The condition or limitation specifies that the interest in the property will cease upon the occurrence of an uncertain event, such as the transferor's insolvency or bankruptcy.

It includes an exception for conditions that benefit the transferor or those claiming under them. This exception allows for conditions inserted in leases, for example, that restrict the lessee from assigning or subletting the leased premises, provided such conditions benefit the lessor or those entitled to the leased property.

Unborn Person

Section 13 of TPA addresses the transfer of property to individuals who are not yet born. This section establishes specific conditions and requirements.

Direct transfer of property to an unborn person is prohibited. Prior Interest is created to hold the property until the unborn person comes into existence. Prior interest must be created in favor of a living person. This ensures that the property remains under ownership until the unborn person is born.

Absolute Transfer: The transfer to the unborn person must be absolute i.e the entire property is transferred without possibility of further transfer.

The living person, serving as an intermediary at the time of transfer, receives a life interest in the property, allowing possession and enjoyment until their demise.

Upon termination of the life interest, the property reverts to the unborn person, provided they come into existence before the life holder's death.

The unborn person must exist before the life holder's demise; otherwise, the property reverts to the transferor or their legal heirs.

Case Law

Girjesh Dutt v. Data Din (1934)

Transfer of property to an unborn person is only valid if it conveys the transferor's entire remaining interest, and not a limited interest. The court upheld the principle of preventing perpetual restrictions on property.

Rule against Perpetuity.

Meaning:

The word 'perpetuity' means indefinite period. The rule against perpetuity, also known as the rule against remoteness of vesting, means that a property cannot be transferred in such a manner that it becomes inalienable for an indefinite period. No transfer of property can establish an interest that becomes effective after the lifetimes of one or more individuals living at the time of the transfer, and the minority of a person.

Purpose:

The purpose of the rule against perpetuities is to ensure the unrestricted circulation of property, which is essential for two main reasons:

1. Facilitate trade and commerce within the country.

2. Enhance the condition of the property itself.

A person who holds absolute rights to property must have the ability to transfer it. Therefore, the rule against perpetuities is also grounded in principles of public policy and fairness.

Rule against Perpetuity prohibits the creation of property interests that would come into effect after the lifetime of one or more living persons at the time of the transfer, and also after the minority of someone who is alive at that time and to whom, if they reach adulthood, the interest is intended to belong.

It prohibits the creation of property interests that are designed to take effect after the lifetime of one or more individuals alive at the time of the transfer, and also after the minority of a person who will be alive at that time and would receive the interest upon reaching adulthood.

Essentials:

1. There must be a transfer of property.

2. The transfer must be intended for the primary benefit of an unborn person who is granted an absolute interest.

3. The vesting of this interest for the ultimate beneficiary must follow life or limited interests of currently living person(s).

4. The ultimate beneficiary must be born before the death of the last currently living person.

5. The vesting of interest for the ultimate beneficiary can be delayed only until the conclusion of the lives of living persons plus the minority of the ultimate beneficiary, but no further.

Exception

Section 18 of TPA carves out an exception to the general rule against perpetuities and perpetual transfers. It permits transfers that endure indefinitely for the benefit of the public good, the promotion of religion, knowledge, commerce, health, safety, or any other purpose deemed beneficial to humanity.

Rambaran v. Ram Mohit (1966)

In this case, Supreme Court determined that the rule of perpetuity is not applicable to personal agreements, which are agreements that do not establish any rights or interests in property. This principle does not extend to mortgages since they do not involve the creation of future interests. Similarly, contracts for perpetual leases are exempt from this rule.

Section 16 of TPA governs transfers of property that are contingent upon the failure of a prior interest. It prevents the creation of subsequent interests that exceed permissible legal boundaries, thereby upholding property rights and ensuring compliance with statutory provisions against perpetuities.

Doctrine of Accumulation

Section 17 of TPA addresses the doctrine of accumulation, which restricts the immediate enjoyment of property transferred. It delineates the regulations governing the accumulation of income and profits derived from the transferred property, ensuring adherence to the principles of the TPA.

Accumulation refers to delaying the transferee's right to beneficially enjoy the income and profits generated from the transferred property. Income and profits can be accumulated for the following periods:

- The lifetime of the transferor.

- A period of 18 years from the date of transfer, whichever is longer.

- Exceptions:

- Accumulation for the purpose of paying debts incurred by the transferor or any interested party exempts Section 17 regulations.

- If accumulation is intended to provide for maintenance or raise portions of income, Section 17 does not apply.

- Accumulation aimed at preserving and maintaining the property also falls outside Section 17 restrictions.

It ensures that the accumulation of income and profits from transferred property adheres to specific limits. It includes exceptions for specific purposes such as debt repayment, maintenance provisions, and property preservation, thereby facilitating property transfers in accordance with the principles established by the TPA.